庞军等:economic impacts of meeting china's ndc through carbon taxes with alternative schemes for recycling tax revenues

发布时间:2024-05-18

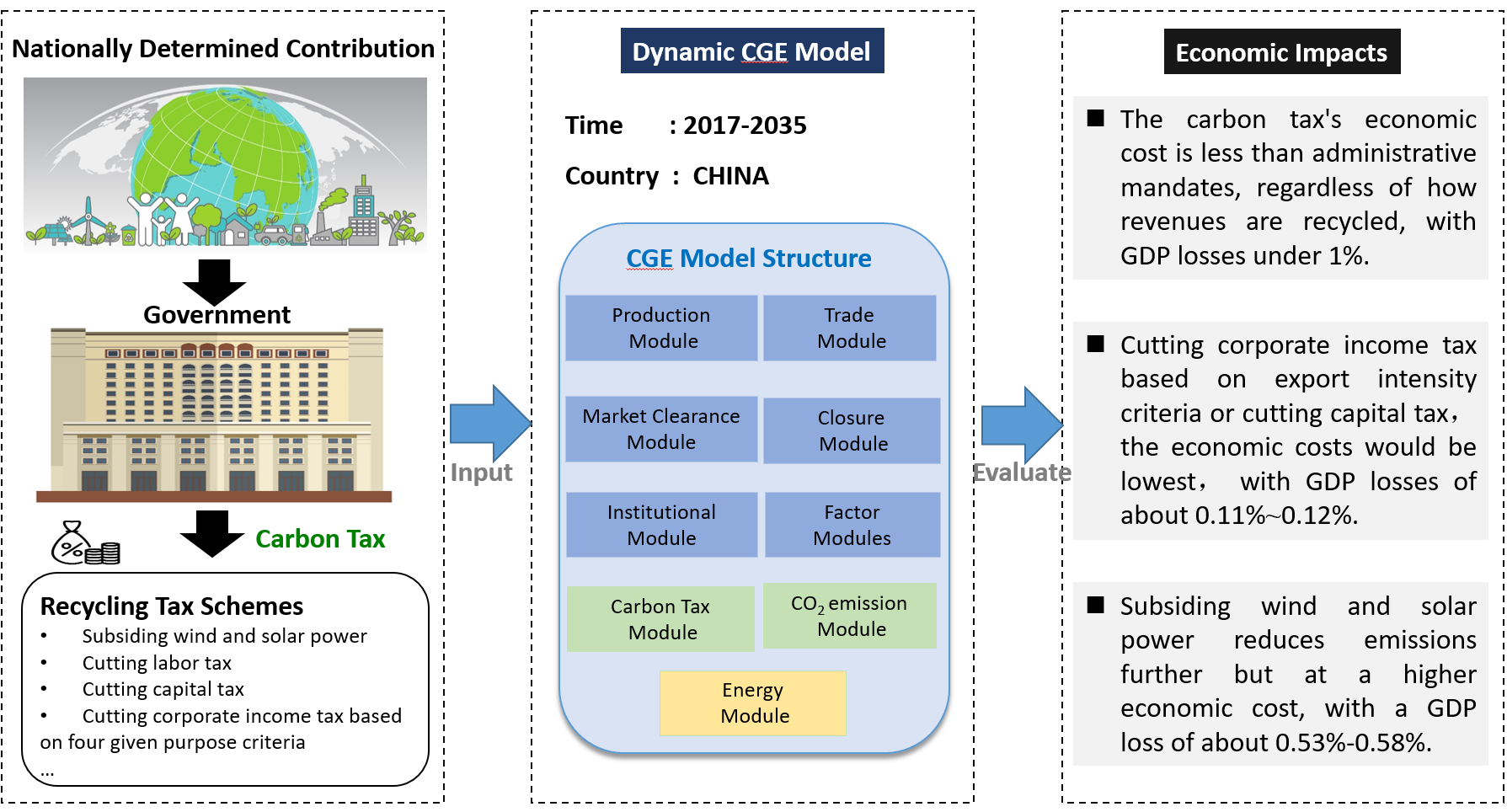

abstracts:this study examines the impact of meeting china’s paris climate agreement commitment to reduce its emission intensity by 65 % below 2005 levels by 2030 through various policy instruments. we use a dynamic recursive computable general equilibrium model to simulate the economy-wide impacts of administrative mandates andcarbon taxes using different revenue recycling schemes. china’s gdp in 2030 would be approximately 1 % lower than the baseline if carbon emissions were constrained by mandates. the commitment’s economic costs are lowerthan the carbon constraint case, regardless of revenue recycling. economic costs are the lowest when carbon tax revenue is recycled to reduce taxes on capital or corporate income. subsidizing solar and wind energy furtherreduces emissions, but at a higher economic cost with a gdp loss of about 0.53 %–0.58 % from the baseline. theresults highlight the importance of proper design architecture to make carbon taxes more palatable to policy-makers and taxpayers.

keywords:climate change; paris climate agreement; nationally determined contributions; carbon tax; general equilibrium model; china

发表于: resources, conservation & recycling 207 (2024) 107696(sci/jcr,q1,2023 if=13.2)

原文链接: